[ad_1]

Polkadot has been noting fall in worth over the previous few days. Though the coin has been laterally buying and selling, there was steady dips within the worth. During the last 24 hours, DOT fell by 4.2% and within the final week the coin introduced house minor good points.

Broader market weak spot could be attributed to most altcoins both buying and selling sideways or transferring downtrend. The coin broke under its essential help of $14 and ever since that Polkadot has been transferring south.

Shopping for energy additionally mechanically pale from the market because the bears took over the value motion. Regardless of the bears strengthening, DOT continued to aim transferring on the upside however the coin was met with promoting stress every time.

The bulls simply must push the value somewhat above the $9.60 mark after which the consumers may try to re-enter the market. This might usher in some aid to the altcoin’s worth.

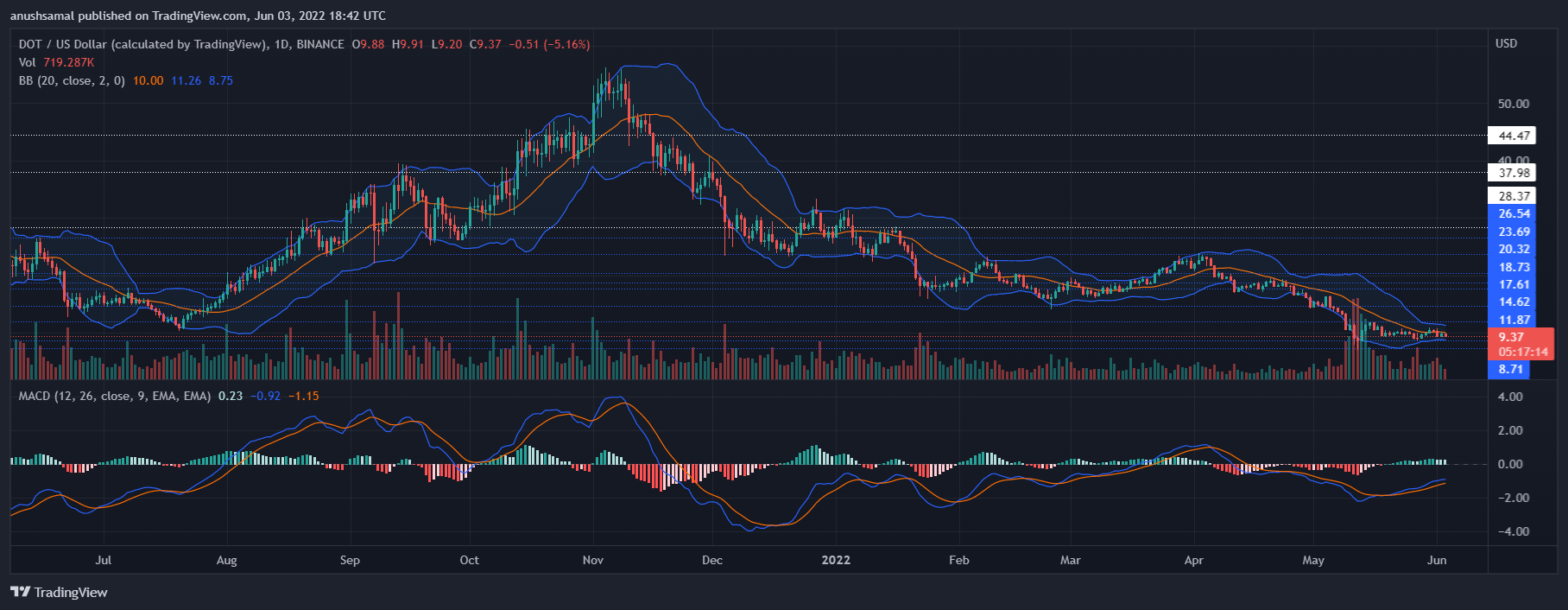

Polkadot Worth Evaluation: One Day Chart

DOT was buying and selling at $9.30 on the sooner or later chart. Polkadot was principally consolidating however was making an attempt to interrupt previous the identical from time to time. Bears have gotten stronger as shopping for energy has fallen. A fall under the $9.30 worth mark will trigger the coin to relaxation on the $8.71 help line.

This might imply DOT would contact the value stage of August, 2021 once more. Overhead resistance for the coin stood at $10 and a push above the identical will make the altcoin commerce close to the $11.87 worth mark.

The quantity of the coin traded had fallen and was seen in purple. This indicated that the bulls had weakened at press time.

Technical Evaluation

DOT famous a constant enhance in shopping for energy as seen on the Relative Power Index. There was an uptrend on the RSI. At press time, the coin displayed fall in shopping for energy because the indicator captured a downtick signifying enhance in promoting stress.

With regard to DOT registering a shift in worth motion, the value pf the asset was seen barely above the 20-SMA line. This meant that consumers had been slowly gathering momentum and that the sellers may not proceed to drive the value momentum available in the market.

Associated Studying | Polkadot Surged Over 4%, What Are The Technicals Indicating?

DOT flashed a purchase sign which quantities to the coin displaying a doable change within the worth motion. Shifting Common Convergence Divergence depicts the value momentum, and it indicated bullishness. MACD portrayed inexperienced sign bars that are tied to a purchase sign.

Bollinger Bands that point out worth volatility confirmed narrowing of the bands. If the bands turn out to be narrowed it signifies that worth volatility is about to drop.

A drop in the identical means lesser worth fluctuations. DOT can attempt to rise above the given instant resistance if the shopping for energy will increase available in the market over the instant buying and selling periods.

Associated Studying | Bitcoin NUL Suggests Extra Draw back To Come Earlier than The Backside

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)