[ad_1]

The under is a direct excerpt of Marty’s Bent Problem #1222: “The Fed is formally fearful of bitcoin (or quietly making an attempt to endorse it)” Join the publication right here.

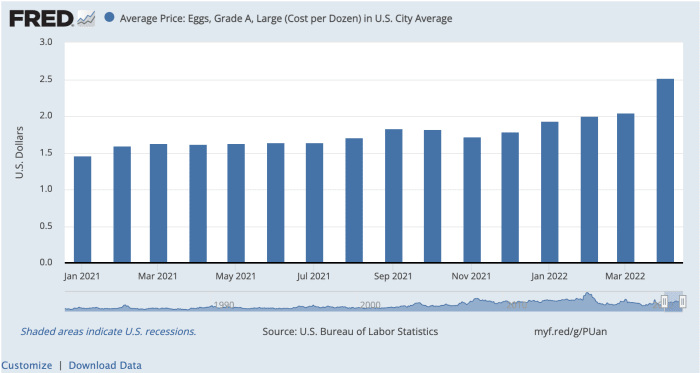

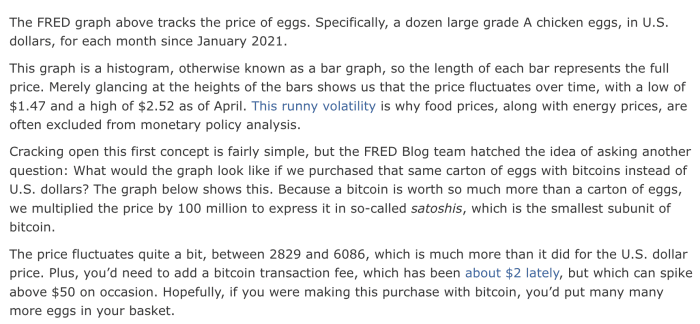

The comedians over on the St. Louis Federal Reserve dropped a weblog submit earlier at the moment that in contrast the fluctuation of eggs costs in U.S. {dollars} and sats from the start of 2021 via April 2022. It looks as if an try to dunk on bitcoin, however if you happen to look intently on the charts you will see that the general inflation fee of eggs over the cherry-picked timeframe is decrease in sats (44.3%) than it’s in {dollars} (71.9%). Certain, bitcoin’s worth did fluctuate extra quickly over the timeframe, but when the Fed goes to cherry choose knowledge, we right here at TFTC are going to take action as properly to show why this is not probably the most correct illustration of the scenario.

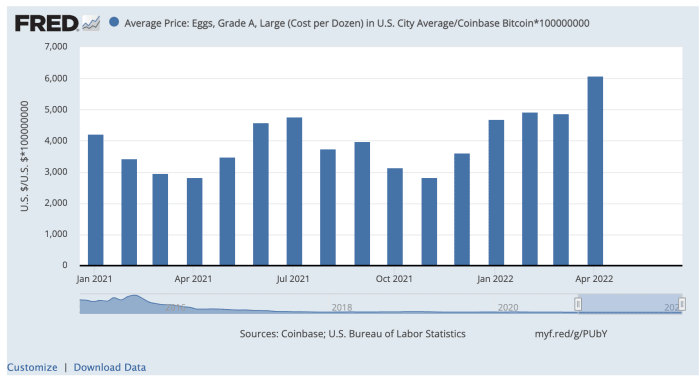

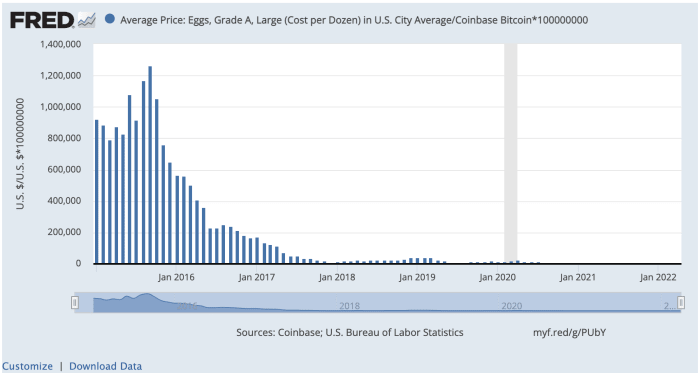

If the Fed have been to be extra sincere — and get their heads out of the gutter of short-termism — they’d share what they shared above, but in addition zoom out a bit (as is made attainable on the very web page of the tried dunk) to present their readers a extra correct depiction of the deflationary tendencies of bitcoin over longer intervals of time and examine it to the U.S. greenback. Since they have been unwilling to do it of their weblog submit, we’ll share that info with you in our rag at the moment.

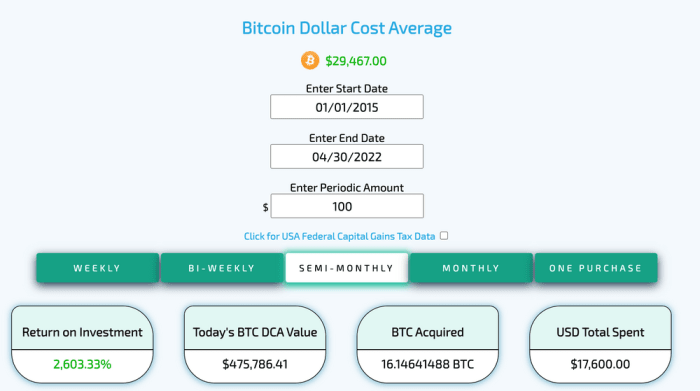

As you possibly can see by zooming out, the value of eggs as measured in sats fell by — *checks notes* — 99.3% since January 2015 (when the Fed began monitoring bitcoin knowledge), whereas rising by 19.2% in U.S. {dollars}. Certain there was some volatility alongside the best way, however over the course of 76 months a person’s buying energy elevated considerably in the event that they have been holding bitcoin. To visualise this enhance in buying energy one other manner, this is what it could seem like if a person have been to take $100 per paycheck because the starting of 2015 to save lots of in bitcoin.

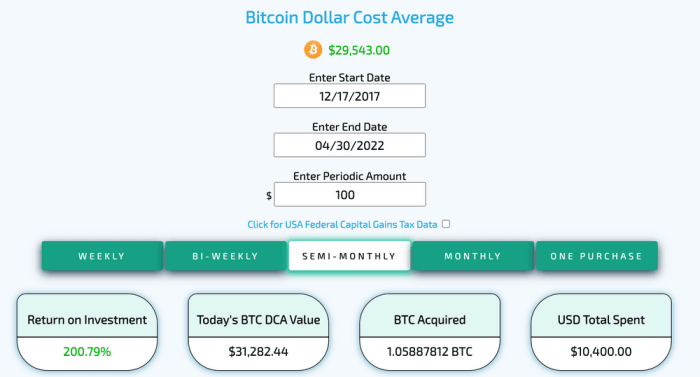

Speak about superior financial savings expertise! And for these of you skeptics on the market seething as a result of bitcoin was buying and selling at $250 close to that cycle’s bear market lows on January 1st, 2015, this is what it could seem like if you happen to started saving $100 value of sats per paycheck starting on the bull market prime of late 2017.

Nonetheless a really spectacular show from the superior financial savings expertise.

A bit odd that the lecturers working on the St. Louis Fed workplace would try to attain dunking factors on bitcoin on this style. Possibly it is a low-key veiled endorsement of the subsequent reserve forex of the world. A refined sign that folks ought to start contemplating bitcoin as their financial good of selection. Is the St. Louis Fed breaking ranks and appearing as a fifth column actor making an attempt to undermine the greenback’s standing from inside?! Nothing would shock your Uncle Marty at this level. It could be very admirable if so.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)