[ad_1]

Logan Bolinger is a lawyer and the writer of a free weekly publication concerning the intersection of Bitcoin, macroeconomics, geopolitics and legislation.

Half Two: The Huge “This” That Bitcoin Fixes

“Politics is the artwork of searching for bother, discovering it in all places, diagnosing it incorrectly and making use of the mistaken cures.” – Groucho Marx

In Half One in all this collection, I wrote concerning the first main breakthrough for me on my journey from being a fervent Bernie Sanders supporter to a dedicated Bitcoiner, which concerned confronting the concept of belief in politics and questioning how Bitcoin’s trustlessness may very well be leveraged towards a optimistic political finish by way of its potential to constrain lawmakers.

Now I need to speak concerning the second main breakthrough I skilled on this journey. I need to begin by suggesting one thing that’s going to sound, at first blush, plainly antithetical to some within the Bitcoin neighborhood, however which I feel may resonate with those that have emigrated to or have arrived at a perception in Bitcoin from a extra left-leaning political beginning place (like, say, the Bernie Sanders/progressive orbit or the liberal arts ecosystem): Progressives and Bitcoiners each determine and acknowledge the same slate of issues with the established order.

Progressives would spotlight and emphasize wealth inequality, unequal monetary entry, monopolies, an overpowerful cadre of tech firms, extra company energy, exploitative (and discriminatory) massive banks and, typically talking, an excessive amount of affect being wielded by a small group of people and firms as main points. This record is clearly non-exhaustive, however I feel it’s a good illustration of main considerations.

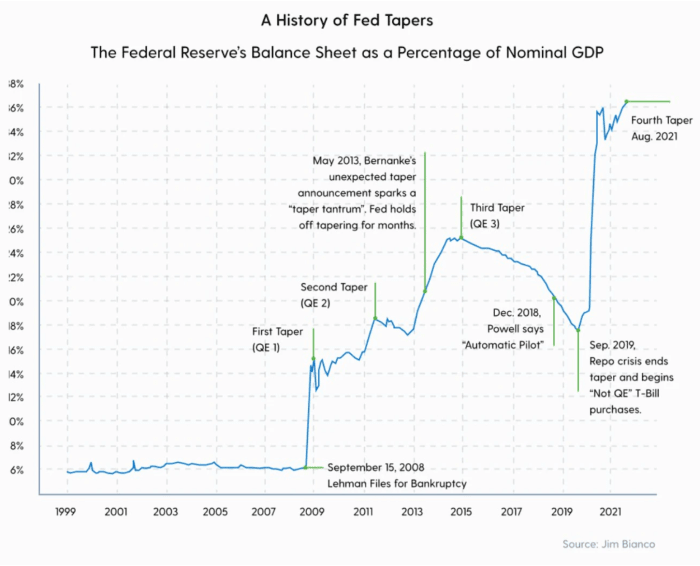

The vast majority of Bitcoiners would agree with most, if not all, of those criticisms, and would most likely add the pursuit of GDP (gross home product) development in any respect prices and ubiquitous malinvestment, each of that are necessitated and sustained by the present fiat system, to the record.

Progressives and Bitcoiners differ radically, nonetheless, on the precise location of the supply of those issues, in addition to on the suitable options to those issues.

These divergent views are analogous to 2 medical doctors analyzing a affected person and agreeing upon the signs, however disagreeing on the treatment. I need to tug on this medical/corporeal metaphor just a little extra to attract out some further factors as a result of it’s illustrative of Bitcoin’s distinctive and transformative promise.

Think about our financial system as a physique. This physique lives arduous and quick and begins to exhibit signs of unwell well being. Two medical doctors study this physique and suggest two starkly totally different cures. Physician A suggests giving the affected person some drugs, which is to say a focused pharmacological intervention, and sending her on her means. Then Physician B means that the foundation reason behind the signs are deeper and recommends elementary way of life adjustments. This physician endorses common train, clear consuming, ingesting much less alcohol, spending extra time outdoors and the like. The affected person opts for the straightforward prescriptions of Physician A.

It doesn’t take lengthy for the affected person to return to see these two medical doctors with new and worsening signs. It seems the drugs has had uncomfortable side effects, which now should be addressed. Physician A suggests further tablets to deal with these uncomfortable side effects, whereas Physician B continues to advocate wholesale way of life adjustments to essentially deal with the foundation reason behind the affected person’s situation.

You possibly can see the place that is going. Reactively addressing signs with out ever treating the underlying problem or worse, misdiagnosing/mislocating the underlying problem, ends in a sicker affected person with extra issues.

Bringing it again to Bitcoiners and progressives, Bitcoiners find the supply of many issues on the financial stage. The cash is now not sound and that is the provenance of most of the subsequent societal signs. Bitcoiners can hint this downside to a exact cut-off date, 1971, the purpose at which cash successfully grew to become debt and foreign money formally grew to become unbacked. From there, issues emerged, multiplied and compounded. Because of this, Bitcoiners suggest fixing the cash with the intention to start therapeutic the litany of consequent societal maladies.

However, progressives coalesce round totally different causal narratives. Generally it’s the billionaires, generally it’s capitalism itself, generally it’s firms, generally it’s Mark Zuckerberg, and many others. Generally the narrative simply devolves or settles into an amorphous, all-encompassing oppressor/oppressed framework by which each human relationship or sphere of human motion will be (and is) categorized by and by way of this binary. On this atmosphere, scoring rhetorical factors too typically takes priority over formulating considerate, thoughtful options. As an alternative, proposed options virtually at all times contain shoveling extra {dollars} at varied events.

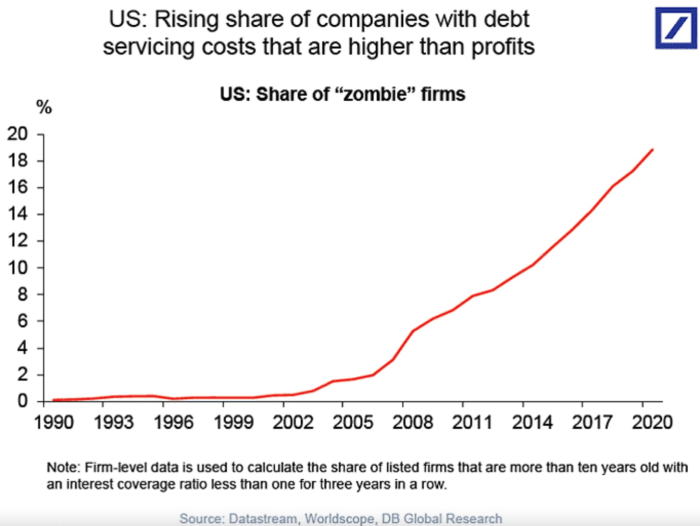

Earlier than I found Bitcoin, I used to be a loyal advocate of spending nonetheless a lot cash was essential to “repair” issues like wealth inequality, extra company energy, inequitable entry to companies, and many others. This, I got here to study, solely briefly relieves the ache, whereas leaving intact the financial system that causes the ache within the first place. We are able to see this as we speak with inflation. We pumped the financial system stuffed with liquidity and handed out stimulus checks. Sounds nice, proper? Virtually two years later and, wouldn’t you understand it, that cash did have to come back from someplace in spite of everything. And by rising the cash provide so dramatically to undertake these (largely) well-intentioned interventions, we ensured the inflation we are actually experiencing. The brunt of which is borne by the identical wage-earning savers for whom the stimulus was meant to help.

IMF; M2 knowledge; Central Banks (Source)

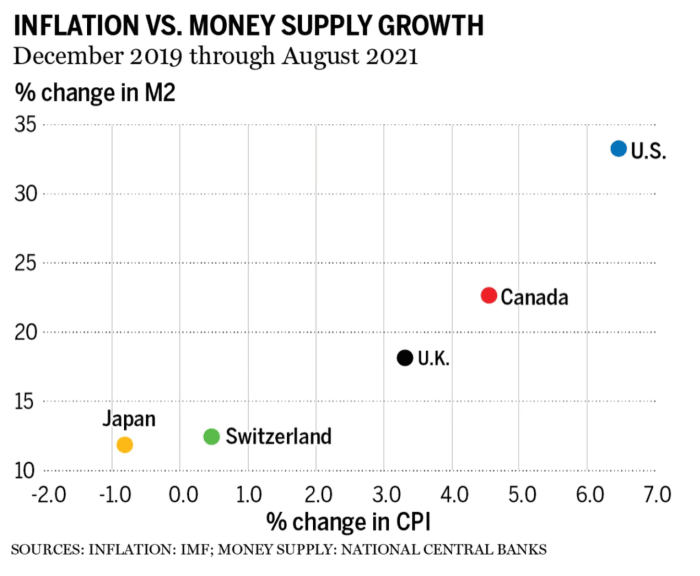

Moreover, the Federal Reserve Board is now within the place of elevating charges in a slowing development atmosphere with the intention to curb this inflation, which is able to itself possible trigger a recession — persevering with to hurt wage-earning savers. When the ache reaches a tipping level, the Fed will step again in once more with a brand new painkiller of liquidity, devalue the foreign money much more, additional enriching the rich asset holders, whereas additional punishing the wage-earning savers. We are going to proceed this vicious cycle, failing to unravel any of the issues we had been in search of to deal with. Fiat options can’t clear up essentially fiat issues.

Jim Bianco / Bianco Analysis (Source)

In different phrases, we’ll simply proceed to deal with the signs till they change into too quite a few and in the end, terminal.

As an apart, I discover it attention-grabbing that the Western world, with its globally distinctive conception of ache and its painkiller medical tradition (versus a extra holistic Japanese strategy of finding and addressing the supply of ache) opts to deal with its financial system the identical means. The federal government treats the cash the way in which Huge Pharma treats well being and will get comparable outcomes.

However anyway, treating the signs of a diseased financial system with out addressing the trigger has the perverse impact of merely delaying extra extreme and doubtlessly terminal future signs, whereas exacerbating the prevailing signs within the meantime.

If I had not discovered Bitcoin, I’m unsure I ever would have understood this. And I think there’s a cause for that. Studying about Bitcoin incentivizes monetary and financial literacy, which is neither extensively taught nor extensively distributed. I don’t suppose it strains credulity to counsel that most of the of us in Congress charged with making these essential selections about fiscal spending, the price range, and authorities debt are equally underinformed concerning the downstream penalties of standard interventional concepts, a state of affairs that’s compounded by an overarching curiosity in profitable re-election. Promising handy out extra money, no matter the place that cash comes from and no matter any grave future penalties it might produce, is a a lot simpler political promote to constituents than the pursuit of economic self-discipline. The previous is a painkiller that briefly masks its root causes. The latter is a painful withdrawal that, as soon as undertaken and accomplished, provides hope for extra lasting long-term well being.

I used to be a Bernie supporter as a result of I wished to deal with a litany of societal issues. I’m now a Bitcoiner as a result of I do know that deca-billionaires, dominant firms, “late-stage capitalism” and Mark Zuckerberg — although definitely objectionable — are usually not the causes of those issues. They’re the signs of a damaged cash. And trying to unravel for these discrete signs will solely end in systemic contortions that enable different signs to metastasize. It’s whack-a-mole problem-solving.

Put merely, Bitcoin made me understand that it’s unattainable to unravel the issues attributable to fiat cash throughout the fiat framework. It’s, in reality, unattainable to have a fiat system by which these issues will be averted. Which is why true options, the “massive structural adjustments” that progressives like Elizabeth Warren tout and demand, require a rebuilding of the system itself upon a greater basis, which implies fixing the cash.

Bitcoin’s promise is the prospect of fixing this. And anybody who’s severe about addressing all the problems progressives and Bitcoiners agree upon should confront the foundation reason behind an entirely, irreparably damaged cash on the base layer of society.

This can be a visitor put up by Logan Bolinger. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)