[ad_1]

Roughly two months in the past on April 11, the stablecoin economic system was valued at $190 billion and was getting nearer to surpassing $200 billion in worth. Nonetheless, after the Terra stablecoin fallout, the fiat-pegged token economic system misplaced $16.31 billion in worth since then. Whereas that worth was erased from the stablecoin market, stablecoins themselves represented 9.35% of your entire crypto economic system’s internet U.S. greenback worth on the time. 61 days later, the crypto economic system is value roughly $1.15 trillion and the stablecoin economic system represents 13.8% of that whole in the present day.

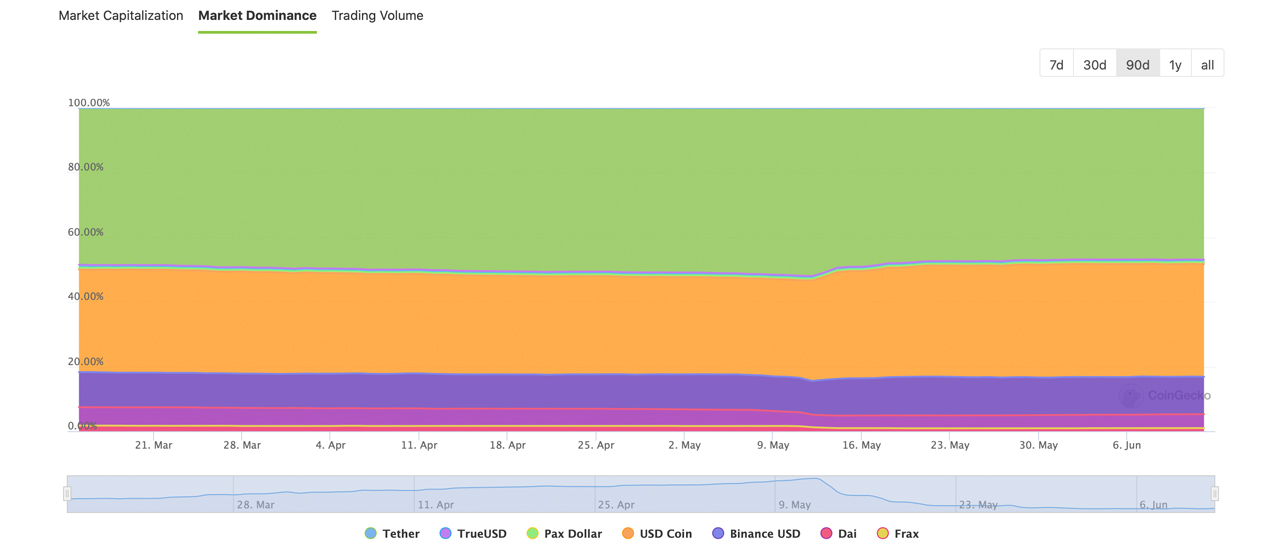

In 61 Days, Stablecoin Dominance Swelled From 9% to 13.8%

For the primary time in historical past, three stablecoins have been high ten digital currencies when it comes to market valuation 36 days in the past on Might 6, 2022. On the time, it was tether (USDT), usd coin (USDC) and terrausd (UST), however that was earlier than the UST implosion.

Whereas terrausd is gone, there’s nonetheless three stablecoins within the high ten in the present day, as binance usd (BUSD) is the seventh-largest crypto asset so far as market cap is anxious. Two months in the past on April 11, the stablecoin economic system was valued at $190 billion however in the present day, the valuation of the stablecoin market is now $159 billion.

On that day in April, your entire crypto economic system was valued at $2.03 trillion and in the present day it’s value roughly $1.15 trillion. Although Terra’s UST fallout noticed billions depart the stablecoin economic system, it dominates by much more than it did when it was nearing $200 billion.

Stablecoins account for entire lot of commerce quantity as properly, and on the time of writing, fiat-pegged tokens have seen $46.1 billion in commerce quantity, whereas all of the crypto property mixed noticed $71.6 billion. The info exhibits that 64.38% of all of the digital forex trades in the present day are swapped towards stablecoin pairs.

As an illustration, tether (USDT) trades account for 60.26% of bitcoin’s (BTC) world commerce quantity whereas BUSD instructions 10.05%. USDT and BUSD are BTC’s high two buying and selling pairs on the time of writing, based on cryptocompare.com metrics.

Tether (USDT) remains to be the king of stablecoins with an $72 billion market valuation that represents greater than 6% of your entire crypto economic system. Usd coin (USDC) is the second-largest stablecoin by market cap with $53.7 billion in worth.

USDC dominates in the present day by greater than 4% of the crypto economic system and mixed each USDC and USDT make up 76.92% of your entire stablecoin dominance of 13.40%. BUSD in the meantime, represents 1.58% of your entire crypto economic system. That leaves slightly greater than 1% of the crypto economic system that stem from stablecoins like DAI, FRAX, TUSD, and USDP.

What do you concentrate on the stablecoin economic system representing 13.8% of your entire crypto economic system? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link