[ad_1]

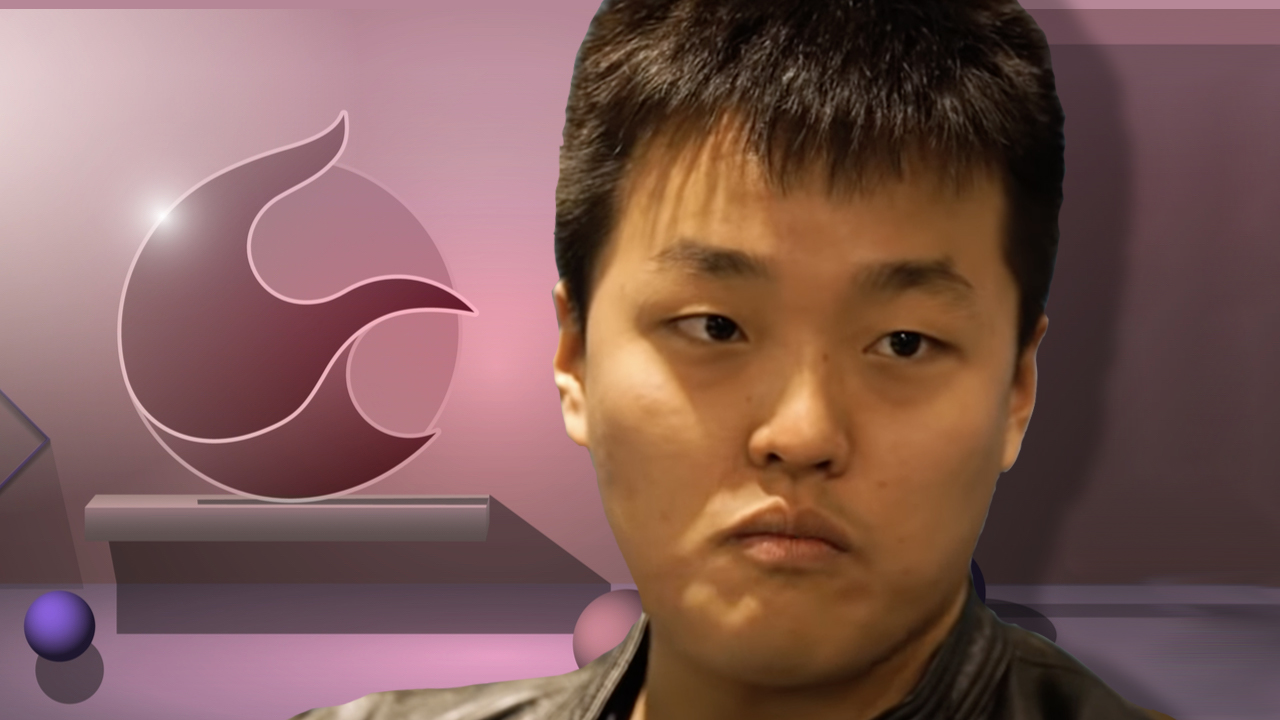

Terra’s new LUNA 2.0 token has misplaced 54% in worth within the final two weeks, after reaching $11.33 per unit on Could 30. In the meantime, the whistleblower Fatman has accused Terra’s co-founder Do Kwon of cashing out $2.7 billion a number of months earlier than the UST de-pegging incident. Kwon, nonetheless, has been preserving tabs on Fatman’s accusations and he claims the allegations are “categorically false.”

LUNA 2.0 Token Drops 54% in Worth In the course of the Final 2 Weeks

The LUNA 2.0 rebirth token has been extraordinarily lackluster when it comes to market efficiency through the previous two weeks. Nonetheless, as Bitcoin.com Information reported six days in the past, a myriad of decentralized finance (defi) protocols have re-joined the ecosystem.

Terra’s 2.0 chain has roughly $1.32 billion locked within the Stader defi software in response to defillama.com stats. The Terra Basic chain nonetheless has $10.54 million complete worth locked in defi immediately as properly, with $3.11 million held on Terraswap and $2.47 million locked into Anchor.

In the course of the previous two weeks, after LUNA 2.0 tapped a excessive of $11.33 per unit, the brand new LUNA has misplaced 54% over the past 14 days. It’s nonetheless down 86% from the all-time excessive at $18.87 per coin when the two.0 blockchain was first launched.

On the time of writing, LUNA 2.0 has $135 million in world commerce quantity, which pales compared to the amount luna basic (LUNC) noticed previous to the fallout. The highest exchanges when it comes to commerce quantity for LUNA 2.0 embrace Bitrue, Okx, Huobi World, Kucoin, and Gate.io. LUNA 2.0’s high 5 buying and selling pairs immediately embrace USDT, USD, USDC, EUR, and ETH, respectively.

Terra Co-Founder Do Kwon Continues to Be Accused of Shady Acts — Whistleblower Fatman Claims Kwon Cashed Out $2.7 Billion Earlier than UST Collapse

Whereas LUNA’s market efficiency has not been so scorching, alongside quite a lot of crypto property struggling by way of the bear market, Do Kwon continues to be being accused of shady acts by the whistleblower Fatman.

Ought to we begin utilizing the time period Kwonzi extra usually? I suggest a definition.

Kwonzi: a monetary scheme with borrowed components from and the same negative-sum nature to a Ponzi however not a Ponzi – cleverly obfuscated by refined manipulation, authentic know-how, and jargon.

— FatMan (@FatManTerra) June 12, 2022

Three days in the past, Bitcoin.com Information additionally reported on the U.S. Securities and Trade Fee (SEC) reportedly investigating the terrausd (UST) collapse and the corporate Terraform Labs (TFL). On June 11, 2022, Fatman accused Kwon of siphoning $2.7 billion from the Terra challenge a number of months earlier than the UST fallout.

“A few of you thought $80m per 30 days was dangerous,” Fatman tweeted. “That’s nothing. Right here’s how Do Kwon cashed out $2.7 billion (33 x $80 [million]) over the span of mere months due to Degenbox: the right mechanism to empty liquidity out of the LUNA [and] UST system and into arduous cash like USDT.”

Fatman says the defi borrowing protocol Abracadabra’s Degenbox and tokens like SPELL and MIM had been used to offer “deeper exit liquidity to the UST pair.” The whistleblower mentioned that Kwon was capable of money out by way of the MIM/UST pool to the tune of $2.719 billion with out shifting the peg.

“UST is the long run, he mentioned. Decentralized cash is sound cash, he mentioned,” Fatman continued. “UST gained’t de-peg, he advised you. ‘Centralized stablecoins will rug you ultimately.’ So why did he money out $2.7b from UST into USDT and USDC?”

Do Kwon Refutes Money Out Accusations, Says He ‘Actually Doesn’t Care About Cash A lot’

Nonetheless, Do Kwon has refuted the claims he cashed out $2.7 billion earlier than the UST crash. “This must be apparent, however the declare that I cashed out $2.7B from something is categorically false,” Kwon mentioned the identical day Fatman accused him. Kwon additionally has his Twitter account set to private mode and solely individuals Kwon tags in a tweet can reply.

“Two contradictory claims appear to exist the place: Do’s wallets are doxxed, and he nonetheless owns most of his luna by way of the airdrop [or] Do dumped all his tokens to make billions,” Kwon continued. “A lane ought to ideally be picked.” The Terra co-founder added:

To reiterate, for the final two years the one factor I’ve earned is a nominal money wage from TFL, and deferred taking most of my founder’s tokens as a result of a) didn’t want it and b) didn’t wish to trigger pointless finger-pointing of ‘he has an excessive amount of.’

On Twitter, individuals have mentioned how Kwon is much more humble now compared to calling individuals “poor” throughout LUNA’s peak fame. Others have been discussing Kwon reportedly “bending over” Abracadabra founder Daniele Sesta and “SPELL bagholders.”

The claims say tokens like SPELL, MIM and Abracadabra’s Degenbox had been used to assist Kwon siphon UST into tougher stablecoin property. Abracadabra and Sesta have already had their share of controversy prior to now with the Wonderland TIME debacle.

[PEOPLE YOU MEET ON THE WAY UP, YOU MEET ON THE WAY DOWN]

Do Kwon (Ponzi @stablekwon) not cares about cash. Bear in mind his favorate insult was “poor”; he did not debate @Frances_Coppola as a result of he “would not debate the poor” & had “no change for her”.https://t.co/B7R8JWDWJT— Nassim Nicholas Taleb (@nntaleb) June 12, 2022

Terra’s co-founder Kwon burdened on Twitter that none of what’s being mentioned about him cashing out is true. “Hope that’s clear – I didn’t say a lot as a result of I don’t wish to appear to be taking part in sufferer, however I misplaced most of what I had within the crash too,” Kwon concluded on Saturday in his refutation in opposition to the claims he cashed out $2.7 billion.

“I’ve mentioned this a number of occasions however I actually don’t care about cash a lot. Please say issues which are confirmed and true – in case you are spreading falsehood that simply provides to the ache of everybody who has misplaced,” Kwon added.

In the meantime, Fatman continues to accuse Kwon of soiled tips and the whistleblower has not stopped criticizing Kwon’s ostensible acts, or his present commentary and refutation.

What do you consider LUNA 2.0 and the latest accusations in opposition to Do Kwon? What do you consider Kwon’s refutation? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link