[ad_1]

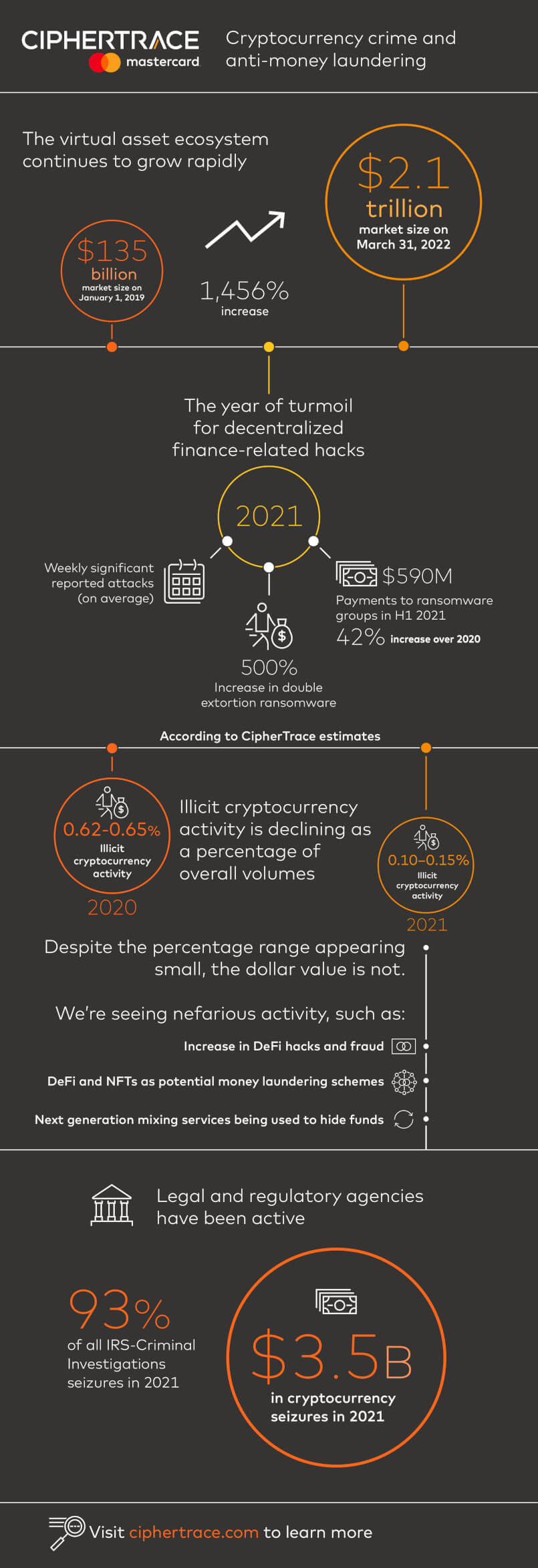

Amid the intense market situations, a June 13 report by CipherTrace particulars constructive developments within the crypto ecosystem, suggesting a decline in crypto-related crimes.

The report confirmed elevated crypto commerce volumes from $4.3 trillion in 2020 to $16 trillion in 2021. The agency claims that this exponential development is why regulators are trying into the crypto ecosystem.

A decline in crypto crime

In keeping with CipherTrace, illicit actions have declined and now represent a small fraction of your entire crypto ecosystem. The agency estimates that illicit exercise, which constituted 0.62% and 0.65% of total cryptocurrency actions in 2020, has dropped to between 0.10 in 2021.

CipherTrace estimates that hackers netted $2.4 billion on an evaluation of the highest ten DeFi hacks in 2021 and Q1 2022. The March 2022 Ronin Community exploit and the 2021 Poly Community hack represent practically half of the general determine.

Whereas this sum is critical, the agency particulars that the quickly increasing ecosystem makes it a small fraction of the general market worth.

The report signifies that the cryptocurrency market grew by 1,456% between 2019 to March 31, 2022. The market hit a peak of $3 trillion in November 2021 after a number of cryptocurrencies rallied excessive.

The agency additionally reported that the majority illicit actions have shifted into DeFi, NFTs, and next-generation mixing providers.

It said that the numbers used within the report don’t replicate the precise worth of illicit actions. It stated, “To caveat, the very fact stays that not all illicit exercise is understood whether or not that’s in conventional monetary channels, in crypto, or in different casual worth transfers. So, take any numbers you see from us or others with that perspective in thoughts.”

Regulators diving deep

Regulators have lengthy expressed considerations about folks utilizing the crypto market as a haven for illicit actions. The numerous development skilled thus led to elevated regulatory measures by governments to maintain tempo.

The report cited President Biden’s crypto government order in March to check blockchain expertise, Dubai establishing a digital property regulator, and the European Union’s proposed Anti-Cash Laundering legal guidelines as examples of such regulatory makes an attempt.

CipherTrace additionally added that the majority regulatory efforts would give attention to curbing the crypto ecosystem’s threats. Which means cryptocurrency organizations would come underneath elevated regulatory watch.

[ad_2]

Source link