[ad_1]

Watch This Episode On YouTube or Rumble

Hear To The Episode Right here:

“Fed Watch” is the macro podcast for Bitcoiners. Every episode we talk about present occasions in macro from throughout the globe, with an emphasis on central banks and forex issues.

On this episode of the “Fed Watch” podcast, I sit down with Tone Vays, a real Bitcoiner and long-time worth and macro analyst of Bitcoin. Our dialogue ranges from the present situations to bitcoin cycles to broader macro subjects together with the state of U.S. politics, Europe and the euro.

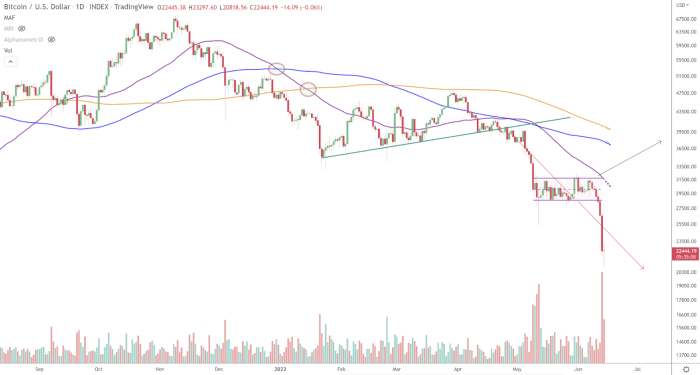

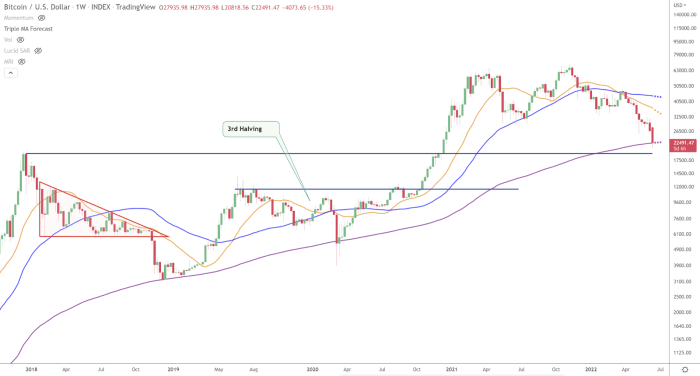

You could find the charts for this episode right here.

Present Bitcoin Market Situations

Within the first phase of the podcast, Vays talks in regards to the psychological state of the bitcoin market.

“I used to be round for the final two bear markets. 2013 was the traditional bubble chart, you had been mentally ready for what’s to come back. 2017, once more, the ICOs, it was an unreasonable exponential rise, so that you had been mentally ready. I wasn’t mentally ready for this one. As a result of, when the highest got here in April 2021, we had an unimaginable quantity of excellent information. Michael Saylor, Elon Musk, Jack Dorsey leaving Twitter to go all in on Bitcoin with Sq. [now Block], El Salvador [legal tender law], then El Salvador shopping for bitcoin.

“That became a promote the information occasion. 50% correction, no massive deal. Everybody was mentally fantastic with it. Then, that is the place it’s all about your psychological state. After we went again and broke that high in November, that was the breakout. Everybody thought we had been going larger; I assumed we had been going larger. That faux out in November was mentally brutal. We crashed again to the $30,000 low, broke right down to $20,000, and during the last three to 6 months individuals have been very, very involved.

“This extended transfer has made individuals tighten their belts. Mentally, they really feel like they had been cheated and don’t assume bitcoin ought to be at these lows. Bitcoin was constructed for this world we’re seeing proper now with all of the uncertainty. They’re stealing financial institution accounts from not simply people, like in Canada, however from sovereign international locations. Bitcoin was constructed for this, however the worth retains happening. Individuals are beginning to throw within the towel. Everyone seems to be saying decrease, decrease, decrease. That is the place I’ve to consider that almost all is all the time mistaken.”

Bitcoin Cycles

I requested Vays about bitcoin valuation fashions and four-year cycles. My query is whether or not they’re all damaged and if we have to discover a new mannequin.

He stated he thinks fashions all the time fail. Inventory-to-flow is theoretically right in Vays’ thoughts, but it surely can’t be efficiently used as a technical indicator. As for the four-year halving cycle, Vays believes that it’s partly as a consequence of hype and partly as a consequence of precise provide shocks.

That’s my place right here on “Fed Watch” as effectively. The four-year halving cycle has its personal hype cycle, utterly separate from the general bitcoin hype. Sort of just like how altcoins attempt to hype their arduous fork upgrades, bitcoin accomplishes that naturally by way of the halving.

Nonetheless, I feel the hype is lessening with every cycle, together with the availability shock facet. That’s the reason I now consider we’ve got a two-year cycle of kinds. A smaller impact from the halving however one that also causes an echo a pair years later.

Vays insightfully factors out that there’s a lot much less of a transparent distinction between bull and bear markets. Value motion in 2020 and 2021 don’t lend themselves to a transparent dividing line. Going ahead, it would turn into tougher to delineate these cycles.

Europe Disaster And International Macro

We began working up on our arduous time restrict earlier than we received into the juicy stuff, so hopefully we will have Vays again on in just a few months to proceed this dialogue. However we did get his opinions on Europe and the euro.

“I’ll say that I’ve a really low opinion of Western Europe. It’s good; you go there and it’s secure. You’ll be able to stroll across the avenue; you’re feeling pretty secure. It has remnants of a collapsing capitalist society, as they hand over all energy to the World Financial Discussion board (WEF). I consider that the WEF is a liberal, socialist group. They’ve an excessive amount of management over politics. To cite Klaus Schwab, ‘We’ve got penetrated the cupboards.’ They usually have.

“I feel the trail of the WEF is a really, very harmful path, and I brief the way forward for Western international locations that purchase into its energy. That’s why I’m very bearish on Europe. I feel the frequent forex will break up.”

We speak about a lot extra, from bitcoin’s correlation to shares and altcoins, to financial coverage. That is one in every of my favourite episodes we’ve ever completed on “Fed Watch,” so it’s undoubtedly a must-listen.

That does it for this week. Because of the readers and listeners. Should you get pleasure from this content material, please subscribe, overview and share!

It is a visitor publish by Ansel Lindner. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)