[ad_1]

One purpose why miners usually pay shut consideration to bitcoin’s worth is as a result of mining machines have a robust optimistic correlation to its fluctuations. And as bitcoin’s dollar-denominated worth has dropped precipitously this month, mining {hardware} costs adopted.

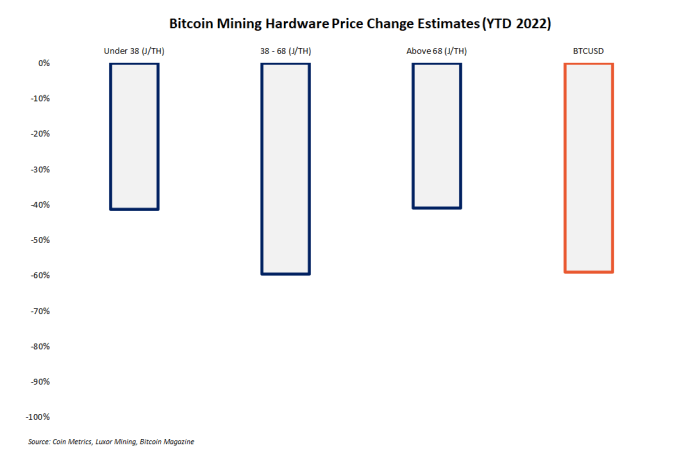

At its current lows, bitcoin was buying and selling close to $17,000, a drop of over 60% 12 months so far. Over the identical interval, costs for essentially the most environment friendly mining machines fell by 41%, as detailed beneath.

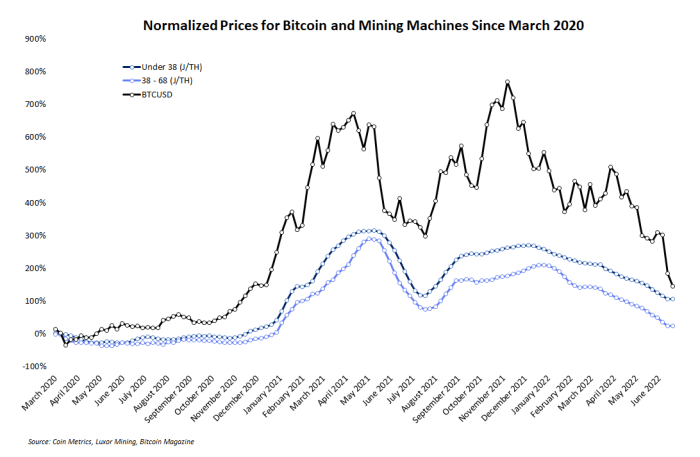

Observing the connection between costs for bitcoin and bitcoin mining machines gives helpful perception into the mining sector’s response to bitcoin worth volatility and timing for accumulating discounted {hardware}.

This text overviews present market pricing knowledge for bitcoin mining machines, its correlative relationship to bitcoin itself, and discusses how and when miners would possibly think about participating with the summer season {hardware} selloff as patrons.

Inside The Newest Bitcoin Mining {Hardware} Pricing Information

Essentially the most- and least-efficient tranches of mining {hardware} have seen the smallest year-to-date worth declines, in line with market knowledge curated by Luxor Mining. Machines with efficiencies above 38 joules per terahash (J/TH) and beneath 68 J/TH have seen roughly 40% declines since January. Over the identical interval, bitcoin has dropped roughly 60%.

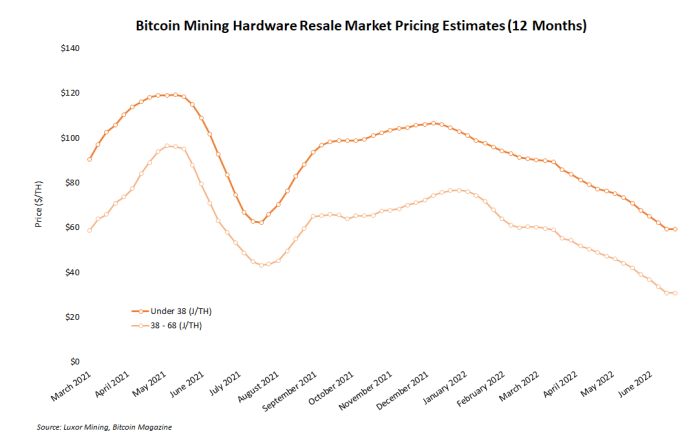

Regardless that current worth declines for bitcoin and a few mining machines have been related on a proportion foundation, the downward tendencies didn’t begin or progress totally in sync with one another. The road chart beneath reveals two peaks in bitcoin’s worth throughout April 2021 and November 2021. Readers will discover that costs for the mining machines (knowledge proven for the top-two effectivity tiers) didn’t peak till roughly a month later in each instances.

Regardless that machine costs are carefully correlated to bitcoin’s worth, they nonetheless lag behind it. The next part provides a short rationalization for why, however potential patrons can usually use fluctuations in bitcoin’s worth as a near-term indicator of the place machine costs are more likely to.

Why Mining Machine Costs Comply with Bitcoin Worth

Costs for bitcoin mining {hardware} are carefully correlated to bitcoin’s worth for 2 key causes.

For one factor, since hash price typically follows or lags behind bitcoin’s worth actions, the costs of bitcoin mining {hardware} — the supply of hash price — additionally lagging behind needs to be anticipated. The explanation for that is simply defined: For instance, when bitcoin is in a sustained downward worth development, some miners which can be going through dwindling earnings select to unplug and even liquidate their {hardware}, which introduces extra promote strain on the mining {hardware} market.

This similar state of affairs reverses throughout bullish intervals when miners – incentivized by climbing mining income – accumulate and deploy new machines. After all, market actions in each development (up or down) by no means occur this cleanly, however typically, this evaluation explains the incentives that trigger machine costs to observe bitcoin’s worth.

Since hash price typically follows bitcoin’s worth, costs of bitcoin mining rigs additionally lagging behind needs to be anticipated.

Mining {hardware} costs additionally are likely to lag bitcoin due to their fundamental operate as “cash printers,” which makes their homeowners, who’re inherently long-term bullish, reluctant to swiftly promote them. Between the working prices, capital expenditures and total bullish ideology required to even begin mining, this sector of the Bitcoin economic system is all the time essentially the most heavily-leveraged lengthy, by a major margin. When the worth goes up, miners are keen to purchase extra hash price. However when the bitcoin worth begins to dip, miners with skinny revenue margins and poorly-planned operations — regardless of their bullish philosophies – are pressured to cease hashing and sometimes to liquidate their {hardware}. In brief, the web cash printers are beneficial, and no one is raring to promote theirs.

It is price noting that slight dips in bitcoin’s worth are often inadequate strain to half a miner from their machines. However sustained downward worth motion like miners have seen for the previous a number of weeks can ultimately pressure less-profitable miners to lift money by promoting {hardware}.

The place To Purchase Bitcoin Mining {Hardware}

The marketplace for mining {hardware} is now bigger and extra subtle than at some other time in Bitcoin’s historical past thanks largely to many firms which have constructed {hardware} marketplaces to service retail miners. Many of those resale markets, nevertheless, are additionally usually utilized by massive institutional patrons that aren’t working straight with producers, like Bitmain or MicroBT.

A number of the main mining {hardware} markets are run by Kaboomracks, MiningStore, Upstream Information and Compass Mining. Different marketplaces exist, however the {hardware} market is rife with scams. The consequences of bitcoin worth drops are already seen within the machine market, with large a number of decrease effectivity {hardware} being listed by miners by means of Kaboomracks, for instance. The corporate even printed a discover that its availability for accepting older machines like Antminer S9s is proscribed, presumably to keep at bay a possible deluge of miners seeking to liquidate.

Mining swimming pools like Foundry and Luxor additionally supply {hardware} brokerage providers for critical miners. However past the corporate names listed on this article, each potential purchaser needs to be abundantly cautious earlier than sending any funds to anybody posing as a vendor of {hardware}.

Retail miners (aka., the plebs) should purchase straight from producers, too. Typically web site buys are restricted or unavailable for small portions (often throughout occasions of red-hot purchaser demand in a bull market), which leaves solely institutional patrons who’ve direct entry to the producer’s crew capable of place orders. However within the present market, producers have steeply discounted dollar-denominated machine costs, and their web site listings are ample.

How Will Bitcoin Mining Machine Costs Change From Right here?

If bitcoin’s worth begins to reverse course and rebound considerably, mining machine costs will ultimately observe. Additional selloffs can even drag {hardware} costs decrease. And in that state of affairs, precisely how low and for a way lengthy mining machine costs will drop is unattainable to foretell.

Extra downward worth actions from bitcoin, nevertheless, are positive to additionally set off extra machine provide on the resale market as less-efficient mining operations shall be pressured to liquidate some property. In both case, bitcoin’s worth will usually act as an indicator for mining {hardware} costs, and typically, miners can plan their machine purchases accordingly.

This can be a visitor put up by Zack Voell. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)