[ad_1]

Margarita Groisman graduated from the Georgia Institute of Expertise with a level in industrial engineering and analytics.

Since trendy capitalism’s emergence within the early nineteenth century, many societies have seen a meteoric rise in wealth and entry to low cost items — with the social gathering coming to an finish years later with some form of main restructuring triggered by a serious world occasion, comparable to a pandemic or a conflict. We see this sample repeat time and again: a cycle of borrowing, debt and high-growth monetary programs; then what we now name in America “a market correction.” These cycles are finest defined in Ray Dalio’s “How The Financial Machine Works.” This text goals to look at whether or not a brand new financial system backed by bitcoin can handle our systematic debt points constructed into the financial system.

There are numerous examples in historical past for instance the long-term drawback with utilizing debt and cash printing to unravel monetary crises. Japan’s inflation following World Warfare II on account of printing monetization of fiscal debt, the eurozone debt disaster, and what appears to be beginning in China, starting with the Evergrande disaster and actual property market collapse in costs and sadly, many, many extra circumstances.

Understanding Banking’s Reliance On Credit score

The basic drawback is credit score — utilizing cash you don’t have but to purchase one thing you may’t afford in money. We are going to all probably tackle a considerable amount of debt sooner or later, whether or not it’s taking up a mortgage to finance a home, taking up debt for purchases like automobiles, experiences like school, and so forth. Many companies additionally use massive quantities of debt to conduct their day-to-day enterprise.

When a financial institution provides you a mortgage for any of those functions, it deems you as “credit-worthy,” or thinks that there’s a excessive probability your future earnings and belongings mixed along with your report of cost historical past might be sufficient to cowl the present price of your buy plus curiosity, so the financial institution loans you the remainder of the cash wanted to buy the merchandise with a mutually-agreed upon rate of interest and reimbursement construction.

However the place did the financial institution get all that money on your massive buy or the enterprise actions? The financial institution doesn’t manufacture items or merchandise and is subsequently producing additional money from these productive actions. As a substitute, in addition they borrowed this money (from their lenders who selected to place their financial savings and further money within the financial institution). To those lenders, it could really feel as if this cash is available for them to withdraw at any second. The fact is that the financial institution loaned it out way back, and charged curiosity charges considerably greater than the curiosity they pay out to money deposits, to allow them to revenue from the distinction. Moreover, the financial institution truly loaned out far more than lenders gave them on the promise of utilizing their future income to pay again their lenders. Upon a saver’s withdrawal, they merely transfer round another person’s money deposit to make sure you pays on your buy instantly. That is clearly an accounting oversimplification, however basically is what occurs.

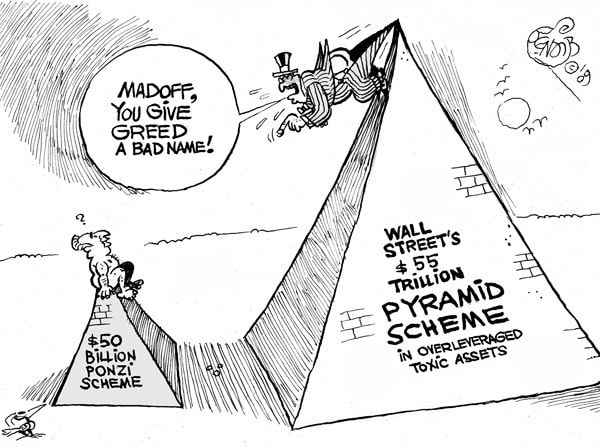

Fractional Reserve Banking: The World’s Largest Ponzi Scheme?

Welcome to fractional reserve banking. The fact of the cash multiplier system is that on common, banks mortgage out ten occasions additional cash than they really have deposited, and each mortgage successfully creates cash out of skinny air on what is solely a promise to pay it again. It’s usually forgotten that these non-public loans are what truly creates new cash. This new cash known as “credit score” and depends on the idea that solely a really small proportion of their depositors will ever withdraw their money at one time, and the financial institution will obtain all their loans again with curiosity. If simply greater than 10% of the depositors attempt to withdraw their cash without delay —for instance, one thing driving shopper concern and withdrawal or a recession inflicting those that have loans not with the ability to repay them — then the financial institution fails or must be bailed out.

Each of those eventualities have occurred many occasions in lots of societies that depend on credit-based programs, although it is perhaps helpful to take a look at some particular examples and their outcomes.

These programs mainly have a built-in failure. Sooner or later, there’s a assured deflationary cycle the place the debt have to be paid again.

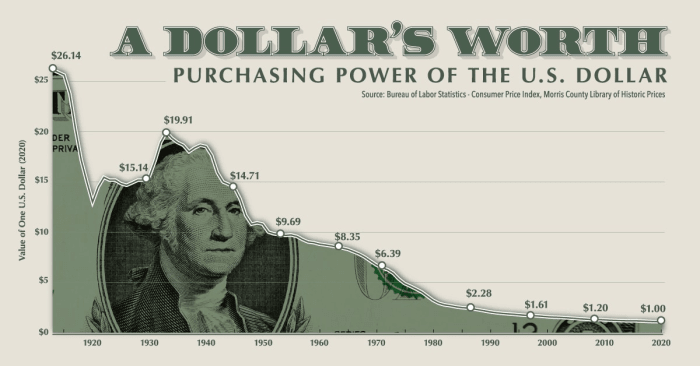

Society Pays For The Financial institution’s Dangerous Loans

There’s a lot to debate by way of how the central financial institution makes an attempt to cease these deflationary cycles by lowering the price for companies to borrow cash and including newly-printed cash into the system. Basically although, short-term options like this can not work as a result of cash can’t be printed with out shedding its worth. After we add new cash to the system, the basic result’s that we’re transferring the wealth of each particular person in that society to the bleeding financial institution by lowering the spending energy of your complete society. Basically, that’s what occurs throughout inflation: Everybody, together with these not initially concerned in these credit score transactions, will get poorer and has to pay again all the present credit score within the system.

The extra elementary drawback is a built-in development assumption. For this method to work, there have to be extra college students keen to pay for the rising prices of school, extra individuals seeking to deposit and get loans, extra house consumers, extra asset creation and fixed productive enchancment. Development schemes like this don’t work as a result of finally the cash stops coming and people don’t have energy to successfully switch the spending energy of the inhabitants to pay these money owed like banks do.

The system of credit score has introduced many societies and people into prosperity. Nevertheless, each society that has seen true long-term wealth era has seen that it comes by the creation of modern items, instruments, applied sciences and companies. That is the one method to create true long-term wealth and produce about development. After we create merchandise which are new, helpful and modern that individuals wish to purchase as a result of they enhance their lives, we get collectively wealthier as a society. When new corporations discover methods to make items we love cheaper, we get collectively wealthier as a society. When corporations create wonderful experiences and companies like making monetary transactions on the spot and simple, we get collectively wealthier as a society. After we attempt to create wealth and large industries that depend on utilizing credit score to wager on dangerous belongings, make market trades and make purchases past our present means, then society stagnates or locations itself on a trajectory towards decline.

Wouldn’t it be potential to maneuver towards a system with a extra long-term targeted outlook with slower however regular development with out the ache of maximum deflationary cycles? First, excessive and dangerous credit score would must be eradicated which might imply a lot slower and fewer short-term development. Subsequent, our unending money printer would wish to finish which might result in excessive ache in some areas of the economic system.

Can Bitcoin Deal with These Points?

Some say that bitcoin is the answer to those issues. If we transfer to a world the place bitcoin isn’t just a brand new type of commodity or asset class, however truly the muse of a newly-decentralized monetary construction, this transition might be a chance to rebuild our programs to assist long-term development and finish our habit to simple credit score.

Bitcoin is restricted to 21 million cash. As soon as we attain the utmost bitcoin in circulation, no extra can ever be created. Because of this those that personal bitcoin couldn’t have their wealth taken from the straightforward creation of latest bitcoin. Nevertheless, trying on the lending and credit score practices of different cryptocurrencies and protocols, they appear to reflect our present system’s practices, however with much more danger. In a newly-decentralized financial system, we should make sure that we restrict the follow of highly-leveraged loans and fractional reserves and construct these new protocols into the trade protocol itself. In any other case, there might be no change from the problems round credit score and deflationary cycles as now we have now.

Cryptocurrency Is Following The Similar Path As Conventional Banking

It’s merely actually good enterprise to mortgage out cash and assure returns, and there are quite a few corporations within the cryptocurrency ecosystem making their very own merchandise round extremely dangerous credit score.

Brendan Greeley writes a convincing argument that loans can’t be stopped simply by switching to cryptocurrencies in his essay “Bitcoin Can’t Change The Banks:”

“Creating new credit score cash is an efficient enterprise, which is why, century after century, individuals have discovered new methods to make loans. The U.S. historian Rebecca Spang factors out in her e book ‘Stuff and Cash within the French Revolution’ that the monarchy in pre-revolutionary France, to get round usury legal guidelines, took lump-sum funds from buyers and repaid them in lifetime rents. In Twenty first-century America, shadow banks fake they aren’t banks to keep away from laws. Lending occurs. You may’t cease lending. You may’t cease it with distributed computing, or with a stake to the center. The income are simply too good.”

We noticed this occur only recently with Celsius as nicely, which was a high-yielding lending product that did basically what banks do however to a extra excessive diploma by lending out considerably extra cryptocurrency than it truly had with the assumptions that there wouldn’t be a considerable amount of withdrawals without delay. When a considerable amount of withdrawals occurred, Celsius needed to halt them as a result of it merely didn’t have sufficient for its depositors.

So whereas making a set restricted provide forex could also be an necessary first step, it doesn’t truly clear up the extra elementary issues, it simply cuts out the present anesthetics. The subsequent step in the direction of constructing a system round long-term and stabilized development, assuming future use of an trade, is standardizing and regulating the usage of credit score for purchases.

Sander van der Hoog gives an extremely helpful breakdown round this in his work “The Limits to Credit score Development: Mitigation Insurance policies And Macroprudential Rules To Foster Macrofinancial Stability And Sustainable Debt?” In it, he describes the distinction between two waves of credit score: “a ‘major wave’ of credit score to finance improvements and a ‘secondary wave’ of credit score to finance consumption, overinvestment and hypothesis.”

“The rationale for this considerably counter-intuitive result’s that within the absence of strict liquidity necessities there might be repeated episodes of credit score bubbles. Subsequently, a generic results of our evaluation appears to be {that a} extra restrictive regulation on the availability of liquidity to companies which are already extremely leveraged is a mandatory requirement for stopping credit score bubbles from occurring time and again.”

The clear boundaries and particular credit score guidelines that ought to be put in place are exterior of the scope of this work, however there have to be credit score laws put into place if there’s any hope of sustained development.

Whereas van der Hoog’s work is an efficient place to begin to take into account extra stringent credit score regulation, it appears clear that ordinary credit score is a vital a part of development and is more likely to web constructive results if regulated appropriately; and irregular credit score have to be closely restricted with exceptions for restricted circumstances in a world run on bitcoin.

As we appear to be step by step transitioning into a brand new forex system, we should guarantee that we don’t take our previous, unhealthy habits and easily convert them into a brand new format. We will need to have built-in stabilizing credit score guidelines proper into the system, or will probably be too troublesome and painful to transition out of the dependence on simple money — as it’s now. Whether or not these be constructed into the know-how itself or in a layer of regulation is but unclear and ought to be a subject of considerably extra dialogue.

Plainly now we have come to easily settle for that recessions and financial crises will simply occur. Whereas we’ll by no means have an ideal system, we might certainly be transferring towards a extra environment friendly system that promotes long-term maintainable development with the innovations of bitcoin as a way of trade. The struggling precipitated to those that can not afford the inflated value of mandatory items and to those that see their life financial savings and work disappear throughout crises which are clearly predictable and constructed into present programs don’t truly need to happen if we construct higher and extra rigorous programs round credit score on this new system. We should make sure that we don’t take our present nasty habits that trigger extraordinary ache in the long run and construct them into our future applied sciences.

It is a visitor put up by Margarita Groisman. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)