[ad_1]

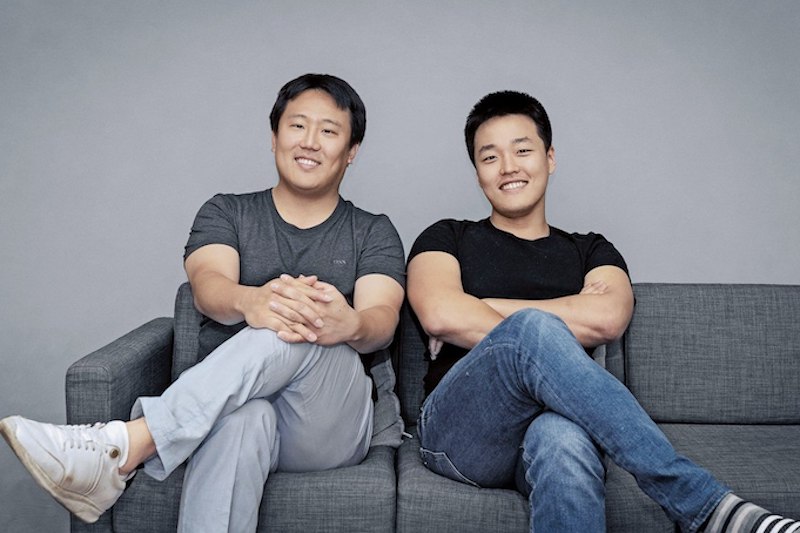

After the LUNA and UST meltdown, many crypto traders have been curious concerning the challenge’s rise in reputation and other people marvel concerning the background of Terra’s co-founder Do Kwon. Furthermore, it isn’t generally recognized that Terraform Labs was additionally based by Daniel Shin, the founding father of a fee agency known as CHAI. After Shin left the corporate, the startup noticed vital development and Kwon turned the principle face of Terra’s ‘Lunatic’ motion.

Do Kwon — A Stanford Graduate That Grew to become the Face of the Terra Cash Venture Following His Accomplice’s Departure

The Terra blockchain fiasco will go down in crypto historical past as one of many craziest occasions over the last 13 years. It began in the course of the second week of Could, when the once-stable coin terrausd (UST) misplaced its peg from its $1 parity. This brought on an enormous financial institution run-like occasion the place billions of {dollars} price of crypto was withdrawn from Curve Finance, Lido, and the decentralized finance (defi) lending app Anchor Protocol.

Terra blockchain’s native token (LUNA) fell considerably in worth as nicely, because the community’s LUNA/UST swapping mechanism drove the coin towards a dying spiral. Terra’s total ecosystem was wiped off the highest crypto initiatives record, and now it’s positioned on the backside of the barrel, amongst a litany of failed digital currencies.

Nevertheless, for fairly a while Terra was thought of one of many hottest blockchain initiatives on the market, and LUNA reached an all-time excessive at $119.18 per unit on April 5, 2022. At present is a unique story, as a single LUNA is now exchanging fingers for $0.00018000 per unit. Whereas many disliked Terra’s co-founder Do Kwon, a large number of folks loved his perspective.

The 31-year-old South Korean native Do Kwon is a Stanford College graduate and in accordance with nymag.com, he allegedly labored for Apple and Microsoft. At Stanford Kwon graduated with a level in pc science. Whereas not a lot is understood about Kwon’s prior historical past, he’s been a member of the crypto group for fairly a while.

In keeping with a report revealed by Coindesk authors Sam Kessler and Danny Nelson, Kwon was allegedly concerned with one other failed stablecoin challenge known as “Fundamental Money.” Former Terraform Labs staff declare Kwon operated the Fundamental Money challenge below the pseudonym “Rick Sanchez.” Kwon is understood for founding Terraform Labs with Daniel Shin, the founding father of a fee agency known as CHAI.

Terra’s White Paper, Terra Alliance, and Capital Injections From Nicely-Identified Backers

The Terra challenge’s white paper was authored by Evan Kereiakes, Marco Di Maggio, Nicholas Platias, and Do Kwon. The white paper particulars that the principle foundations of “Terra Cash” embrace “stability and adoption.” The Terra challenge was created in January 2018 and LUNA’s first recorded market worth was $3.27 per unit on Could 7, 2019. By January 2020, LUNA was buying and selling for a lot decrease values at $0.20 to $0.50 per unit.

Then, in February 2021, LUNA began to achieve vital market traction and ultimately climbed 23,700% to the crypto asset’s all-time worth excessive. Moreover, from October 2020 all the best way till Could 9, 2022, Terra’s stablecoin terrausd (UST) held its $1 parity with the U.S. greenback. Earlier than each of those tokens and the numerous different crypto property constructed on high of Terra, the challenge derived from the group Terra Alliance. The group is a 16-member worldwide community of Asian e-commerce and monetary advisory companies.

In February 2019, Terra Alliance had an total attain of round 45 million customers in ten completely different international locations with platforms equivalent to Musinsa, Yanolja, TMON, and Megabox. TMON was a billion-dollar startup that was based by Daniel Shin and in August 2018, Shin informed the press his new stablecoin challenge raised $32 million.

Traders included Arrington XRP, Kenetic Capital, Binance Labs, FBG Capital, 1kx, Hashed, and Polychain Capital. “We’re happy to assist Terra, which units itself other than most different blockchain initiatives with its established and fast go-to-market technique,” Polychain Capital’s Karthik Raju mentioned on the time.

The challenge’s official mainnet launch was in April 2019 and ecosystem instruments have been made out there just like the block explorer Terra Finder and the pockets Terra Station. In Could 2019, Terraform Labs had a company funding spherical led by Arrington XRP Capital, and in August 2019, Hashkey Capital backed the staff.

In January 2021, Terraform Labs raised $25 million from Coinbase Ventures, Galaxy Digital, and Pantera Capital. The next July, Galaxy Digital, Arrington XRP Capital, Blocktower Capital, and others injected $150 million into an ecosystem fund created by the Terra staff. Moreover, Terraform Labs invested in different firms equivalent to Hummingbot, Stader Labs, Espresso Programs, Leapwallet, and Rain.

Anchor: The So-Referred to as ‘Gold Commonplace for Passive Earnings’

2019 was the 12 months Terra began seeing much more buzz surrounding the challenge and in June of that 12 months, the community had its first protocol improve. A 12 months later in July, Shin’s agency CHAI launched the CHAI card and by January 2020, Shin left Terraform Labs after two years of working with the challenge.

Shin nonetheless leads CHAI company and he nonetheless runs TMON as nicely. Whereas Shin was the face of Terra’s preliminary leap getting backing from Binance in August 2018, it was Kwon who accepted the $25 million in January 2021, and the $150 million in July 2021. Furthermore, in the summertime of 2020, an idea constructed on Terra known as the “Gold Commonplace for passive revenue on the blockchain” was born.

In June 2020, Anchor Protocol’s white paper was revealed and it was written by Nicholas Platias, Eui Joon Lee, and Marco Di Maggio. “Anchor presents a principal-protected stablecoin financial savings product that pays depositors a secure rate of interest,” the white paper explains. Nicholas Platias launched Anchor on July 6, 2020, explaining that the staff wished to do away with the “extremely cyclical nature of stablecoin rates of interest” in defi.

For fairly a while, Anchor Protocol gave depositors a 20% compounding rate of interest till the challenge determined to shift to a dynamic earn fee on the finish of March 2022. The Anchor challenge began to see much more criticism on the time and sustainability issues. Throughout the previous couple of months, Anchor was known as a Ponzi scheme in plenty of social media and discussion board posts written by crypto proponents.

Do Kwon: ‘I Don’t Debate the Poor on Twitter’ and ‘95% of Cash Are Going to Die’

Terra’s stablecoin UST was additionally criticized by the Galois Capital govt Kevin Zhou who predicted the de-pegging incident nicely earlier than it occurred. Do Kwon was admired by a big military of ‘Lunatics’ and regardless of Zhou’s early criticisms, Kwon proudly told folks to proceed staying “poor.” “U still poor?” Kwon requested on social media, “I don’t debate the poor on Twitter,” the Terra founder defined.

Discover how the cockroaches are silent tonight because the 🌕 shines vibrant

As promised, the moon gave no quarter

— Do Kwon 🌕 (@stablekwon) December 22, 2021

Kwon additionally as soon as remarked that “95% [of coins] are going to die, however there’s additionally leisure in watching firms die too.” The Terra co-founder moreover had issues with the U.S. Securities and Trade Fee (SEC) because the regulator took subject with Terra’s Mirror Protocol.

Kwon then mentioned he determined to sue the SEC for not utilizing the right channels to ship his subpoena and that the regulator lacked jurisdiction over Terra’s properties. “The SEC attorneys have been nicely conscious that TFL and Mr. Kwon had persistently maintained that the SEC lacked jurisdiction over TFL and Mr. Kwon, and at no time requested Dentons legal professionals whether or not it was approved to simply accept service of subpoenas,” Kwon’s lawsuit acknowledged. Much like Terra’s suite of stablecoins, Mirror Protocol allowed folks to reflect shares like Amazon or Apple by way of Terra’s blockchain community.

Would like to ask no matter your internet price is and wager 90%

However perhaps that is what that’s already

— Do Kwon 🌕 (@stablekwon) March 13, 2022

Terra’s Story Continues With No Finish in Sight

Now the Terra challenge appears to be like to revive itself from a near-dead state by forking the community and not using a stablecoin. Nevertheless, a whole lot of controversy surrounds the Terra challenge at present and Terra’s co-founder Do Kwon has been blamed for plenty of miscalculated errors. Questions have surrounded the bitcoin (BTC) reserves the Luna Basis Guard (LFG) held to be able to defend UST’s $1 parity.

Later the Singapore-based nonprofit LFG disclosed what the group did with the 80K+ bitcoin (BTC) it as soon as held in its reserves. Then three members of the Terraform Labs (TFL) in-house authorized staff abruptly resigned after the challenge’s fallout and experiences additional famous that Do Kwon dissolved TFL earlier than UST and LUNA collapsed.

Woah. Do Kwon describing Terra’s “Protocol Armageddon” in 2021. “A kill swap” the place TFL “pulls the set off” and disappears from the challenge after reducing all of their ties – “in 24 hours we’re gone.” Is that this probably associated to what’s taking place with Terra 2 this week? pic.twitter.com/jFDx0zLcIy

— FatMan (@FatManTerra) May 20, 2022

Terra rose to reputation fairly rapidly, however the challenge’s demise was even faster. The Terra challenge has not been put out of its distress, and the platform’s native tokens nonetheless have a small quantity of worth. At present, many Terra supporters are hopeful whereas detractors are uncertain that Terra and Do Kwon can revive the damaged blockchain ecosystem.

The market has already determined, for probably the most half, that LUNA and UST aren’t as worthwhile as they as soon as have been. Whether or not or not a Terra fork and airdropping new tokens will assist the challenge come again stays to be seen and it’s secure to say, Terra’s story has not ended.

What do you concentrate on the rise of Terra LUNA and the those who helped Do Kwon? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link