[ad_1]

Bitcoin fell under a previous cycle’s all-time excessive for the primary time ever right now, breaching the $19,776 degree.

The peer-to-peer forex had been struggling to keep up the $20,000 degree over the previous week as liquidation and liquidity woes plagued the market as lenders similar to Celsius Community fell beneath excessive strain.

Bitcoin has misplaced over 30% of its U.S. greenback worth over the previous week, the very best weekly loss for the reason that outset of the COVID pandemic in March 2020 when BTC noticed its worth crash by 33.45% per TradingView information. Bitcoin traded under $18,000 at press time.

Bitcoin broke the 2017 all-time excessive on Saturday – the primary time it fell under a previous cycle’s excessive in its historical past. Picture supply: TradingView.

As rates of interest rise within the U.S. on the quickest tempo in a long time, property perceived as riskier by establishments {and professional} buyers – which embody Bitcoin – have fallen sharply resulting in a snow-ball impact throughout international markets.

The Fed raised rates of interest by 0.75% on Wednesday, the biggest hike by the American central financial institution system since 1994, as inflation has stored rising over the previous yr. The U.S. shopper worth index (CPI) for the yr ended on Could 2022 got here at 8.6%, increased than the month earlier than (8.3%) and representing a brand new 40-year excessive.

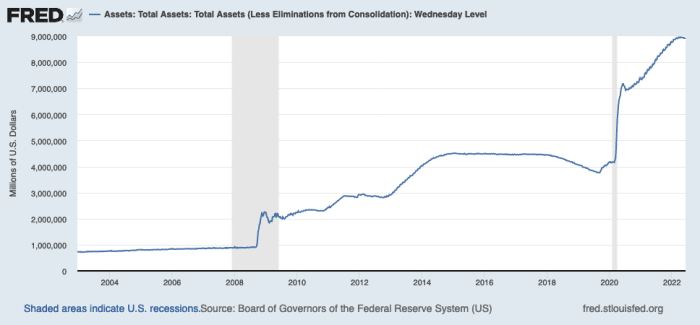

Whereas rates of interest rise, the Fed’s stability sheet has begun shrinking. The central financial institution introduced final month that it could begin a interval of quantitative tightening on June 1, decreasing its asset purchases and holdings – a spin on the insurance policies it had launched into years again.

Notably, Bitcoin has to this point existed in a interval of development of the Fed’s stability sheet. Since 2008, on the outset of the subprime disaster, the central financial institution started aggressively bloating its asset holdings. It stays to be seen what is going to occur with the P2P forex because the Fed tightens.

[ad_2]

Source link

![Guide to Using Multisig Wallets to Secure Your Crypto [2023]](https://bitscoop.io/wp-content/uploads/https://bitpay.com/blog/content/images/2023/03/multisig-wallets-security-bitpay.jpg)